Financial Accounting Exam Questions & Terminology

Get the #1 mobile app from the best seller in this field.

Install now and try it before you buy it.

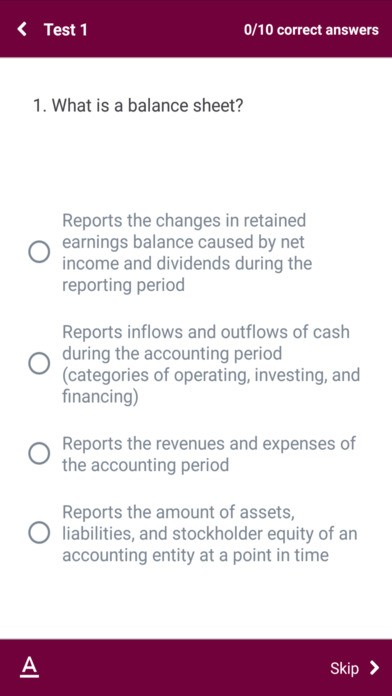

This app contains thousands of real exam questions for self learning & exam preparation on the topic of Financial Accounting, IFRS & GAAP. With our Advanced Smart Learning Technology, you can master the learning materials quickly by studying, practicing and playing at lunch, between classes or while waiting in line.

Financial Accounting Exam prep uses proven study and test-taking strategies so that you’ll feel confident and ready to go when you have to take the Financial Accounting Exam.

Premium Features:

+) Lifetime access to all Practice Questions & Terms prepared by EXPERTS for the most current exam.

+) Unlimited access to the EXAM BUILDER & SIMULATOR.

+) Automatically FILTER your most difficult questions.

+) PROGRESS TRACKING for every question & exam taken

+) Lifetime support & updates

Free version:

+) Hundreds of practice questions & terms

+) 5 Free Exam Builder

+) Free Matching Game

+) Filter hardest and weakest questions

Financial accounting (or financial accountancy) is the field of accounting concerned with the summary, analysis and reporting of financial transactions pertaining to a business. This involves the preparation of financial statements available for public consumption. Stockholders, suppliers, banks, employees, government agencies, business owners, and other stakeholders are examples of people interested in receiving such information for decision making purposes.

Financial accountancy is governed by both local and international accounting standards. Generally Accepted Accounting Principles (GAAP) is the standard framework of guidelines for financial accounting used in any given jurisdiction. It includes the standards, conventions and rules that accountants follow in recording and summarizing and in the preparation of financial statements. On the other hand, International Financial Reporting Standards (IFRS) is a set of international accounting standards stating how particular types of transactions and other events should be reported in financial statements. IFRS are issued by the International Accounting Standards Board (IASB). With IFRS becoming more widespread on the international scene, consistency in financial reporting has become more prevalent between global organisations.

While financial accounting is used to prepare accounting information for people outside the organization or not involved in the day-to-day running of the company, management accounting provides accounting information to help managers make decisions to manage the business.

International Financial Reporting Standards (IFRS) are designed as a common global language for business affairs so that company accounts are understandable and comparable across international boundaries.

International Accounting Standards (IAS), while standards issued by IASB are called IFRS. IAS were issued between 1973 and 2001 by the Board of the International Accounting Standards Committee (IASC).

Disclaimer:

This app is not affiliated with or endorsed by any testing organization, certificate, test name or trademark.